Loans and Debt Management: A Guide for Students

As a student, managing your finances can be challenging. You have to balance your tuition fees, textbooks, rent, food expenses and other miscellaneous costs. Sometimes you may fall short of funds and require financial assistance in the form of loans. However, taking out loans can result in accumulating debt if not managed properly. In this article, we will provide a guide to help students manage their loans and debts effectively.

1) Apply for scholarships and grants first

Before considering taking out any loan, it’s essential to research scholarship or grant options available for your program at school. Scholarships are awarded based on academic achievement or special talents while grants are typically awarded based on financial need. These forms of aid don’t require repayment like loans do.

2) Understand the types of loans available

There are several types of loans available such as federal student loans (subsidized/unsubsidized), private student loans, personal bank loan or credit card debt consolidation loan etc.

Federal student loans typically offer lower interest rates than private ones but have limits on borrowing amounts per year.

3) Know how much you need

Once you’ve decided to take out a loan after exhausting all other financial resources like scholarships and grants – it’s important to only borrow what is necessary for school-related expenses instead of overborrowing which could lead to more debt.

4) Compare interest rates before choosing a lender

Interest rates vary depending on which lender you choose so be sure to compare before making any final decisions about where to get your loan from.

5) Read Terms & Conditions carefully

Before signing up for any loan(s), read through the terms & conditions (T&C’s). Pay close attention to interest rates charged along with repayment plans offered by each lender as these details will impact how much money owed back later down the line when payments come due.

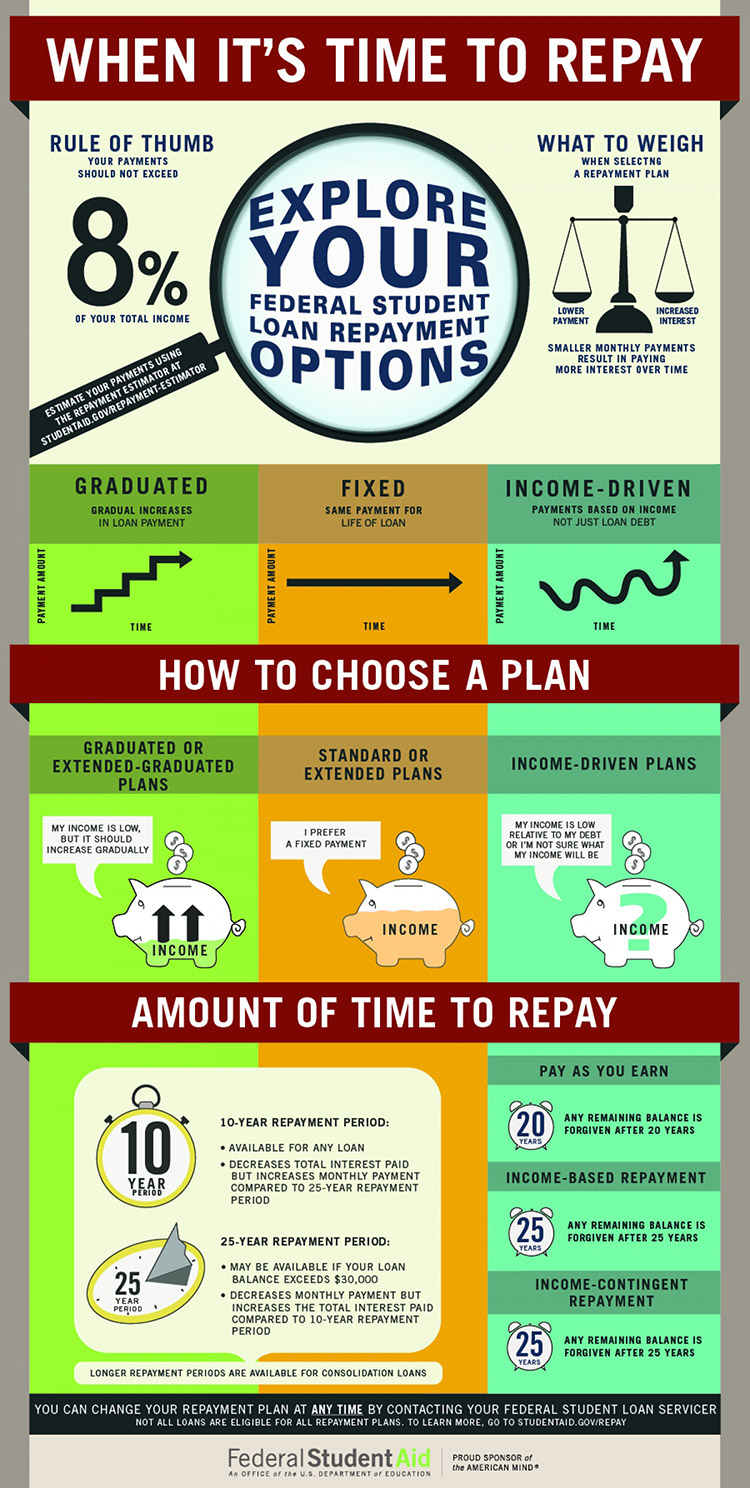

6) Choose an appropriate repayment plan

Repayment plans can vary depending on the lender. Some offer fixed monthly payments while others offer flexible payment options based on income and other factors such as deferment or forbearance in case of financial hardship.

7) Be aware of loan forgiveness programs

Certain professions such as teaching, nursing etc may have loan forgiveness programs available which can help reduce or eliminate debt over time. Check with your school’s financial aid office to see what options are available for you.

8) Make timely payments

To avoid late fees, penalties, and potential damage to your credit score – it’s crucial to make regular payments towards any loans that you’ve taken out. Set up automatic payments if possible to ensure that money is always being put towards paying off debts.

9) Build credit responsibly

Paying off loans regularly is an excellent way to build credit history. It’s essential not to miss any payment deadlines or default on a loan as this could negatively impact your credit score for years down the line.

10) Seek professional advice when needed

If you’re struggling with managing multiple loans or have questions about repayment plans – seek professional guidance from a financial advisor who specializes in student loan debt management.

11) Avoid taking out more loans than necessary

Lastly, it’s important not to fall into the trap of constantly borrowing money without considering how it will affect future finances. Only borrow what is absolutely necessary and work hard towards paying off any existing debts before taking out new ones.

12) Conclusion

Managing student loans and debts requires careful planning along with responsible borrowing practices and repayment strategies. By following these tips outlined above, students can stay on top of their finances while working towards achieving their academic goals without accumulating excessive amounts of debt.

Leave a comment