Cryptocurrency Basics: An Introduction

Cryptocurrencies are digital or virtual currencies that use cryptography for security. They operate independently of a central bank and can be transferred directly between individuals without the need for intermediaries like banks or payment processors.

Bitcoin, created in 2009, was the first decentralized cryptocurrency, followed by thousands of others such as Ethereum, Ripple, and Litecoin. Cryptocurrencies have gained popularity due to their potential to provide fast and secure transactions with relatively low fees compared to traditional banking systems.

How Do Cryptocurrencies Work?

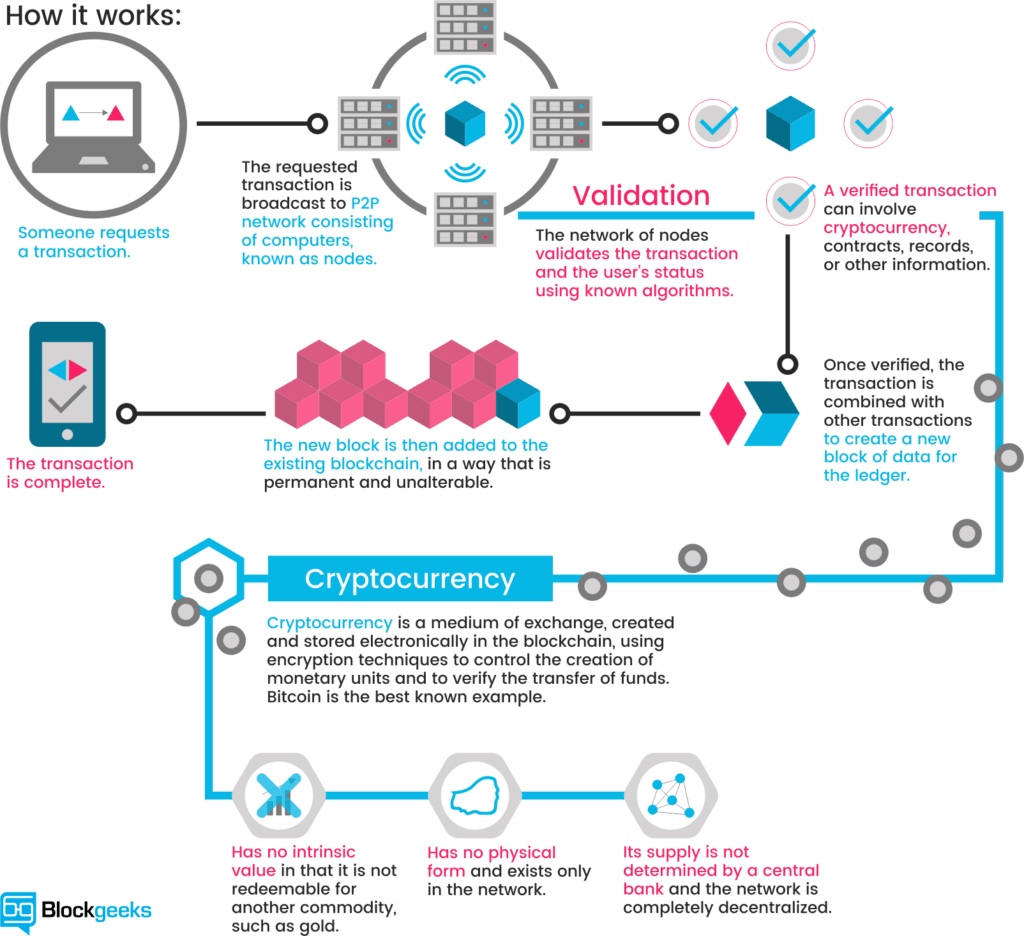

Cryptocurrencies work on a blockchain network that is essentially a public ledger maintained by a network of computers worldwide. Every transaction made on this network is recorded in this ledger as an encrypted block. This makes it impossible for anyone to modify the data or tamper with the transaction history once it’s recorded.

To make a transaction using cryptocurrencies, you need two things – a wallet address and private keys. A wallet address is similar to your bank account number while private keys are used to verify your identity when making transactions from your wallet address. When you send cryptocurrencies from one wallet address to another, miners validate the transaction by solving complex mathematical equations through their computers’ processing power before adding them into new blocks in the blockchain network.

Why Are Cryptocurrencies Popular?

One reason why cryptocurrencies have become so popular is because they offer an alternative form of currency outside of government control or manipulation. People who mistrust centralized financial systems often prefer investing in decentralised assets like Bitcoin that aren’t subject to inflation caused by governments printing more money.

Another reason why people invest in cryptocurrencies is their potential for high returns on investment (ROI). Some early investors have seen exponential growth in value over time leading many others wanting a slice of the pie too.

The Future Of Cryptocurrency

As cryptocurrency adoption continues growing globally, there has been increasing interest from various industries including finance and technology companies looking at ways they can integrate these digital assets into their current businesses.

However, the future of cryptocurrencies is still uncertain as governments worldwide grapple with how to regulate them. Critics argue that they pose a risk to financial stability while others believe that they have the potential to revolutionize global finance by providing an alternative and more democratic form of money.

Conclusion

Cryptocurrencies offer a new way of thinking about money and finance, but there’s still much we don’t know about this asset class. While it may not be perfect, cryptocurrencies hold promise for improving financial access and empowering individuals around the world. It’s worth keeping an eye on developments in this space as it could shape our financial systems for years to come.

Leave a comment