College is a time of new experiences and newfound independence. For many students, it’s the first time they are solely responsible for managing their finances. Money management can be challenging, but with the right tools, strategies, and mindset in place, college students can navigate the financial waters successfully.

Create a Budget

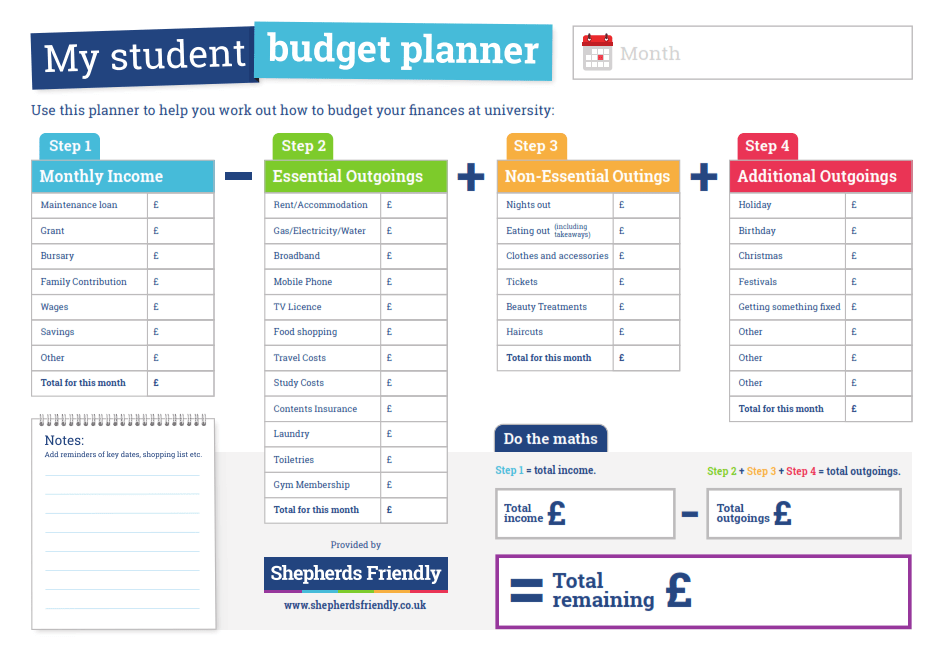

One of the most important things to do as a college student is creating a budget. A budget helps you track your expenses and income to avoid overspending or running out of money before the next paycheck arrives. Start by listing all your sources of income such as scholarships, grants, or part-time jobs. Then list all your fixed expenses such as rent, tuition fees, utilities, grocery bills etc., followed by variable expenses like dining out and entertainment costs.

Live Within Your Means

Living within your means is another vital aspect of money management for college students. With so much pressure to conform to social norms like eating out regularly or buying expensive gadgets that may not be necessary; it’s easy to fall into debt traps.

To avoid this pitfall it’s best if you prioritize needs over wants; focus on essentials rather than splurging on luxuries that don’t contribute towards academic success.

Use Credit Cards Wisely

Credit cards can be an excellent tool when used wisely but could also lead one down a road of debt if misused. College students should understand that credit card companies often offer enticing rewards programs like cashback incentives or frequent flyer miles – which may tempt them into overspending beyond their means.

To use credit cards responsibly: always pay bills on time; keep balances low and only spend what you can afford; never exceed more than 30% utilization rates (the amount borrowed versus total available credit limit); read terms & conditions carefully before signing up for any reward program because some offers have hidden charges associated with them that could balloon up quickly if not monitored closely!

Track Your Expenses

Tracking expenses is essential because it gives you a clear understanding of where your money is going. It helps you identify areas where you can cut back and save money, which is especially helpful if you’re on a tight budget.

To track expenses effectively, consider using apps like Mint or PocketGuard that help users categorize their spending habits into different buckets such as entertainment, transportation, groceries etc., to get an accurate picture of their finances.

In conclusion, managing money as a college student requires discipline and focus. By creating a budget, living within your means, using credit cards wisely, and tracking expenses; one can avoid the common pitfalls associated with poor financial management. With these tools in place along with good habits around saving for emergencies or future goals; college students will be well on their way towards achieving their financial goals!

Leave a comment