Tax Planning: 15 Essential Tips for Parents of Alternative Schooling and Education

As a parent who has chosen alternative schooling and education, you know that providing your child with the best education possible is not limited to what happens inside the classroom. You also need to think about how you can maximize your financial resources so that you can support your child’s education without breaking the bank. That’s where tax planning comes in.

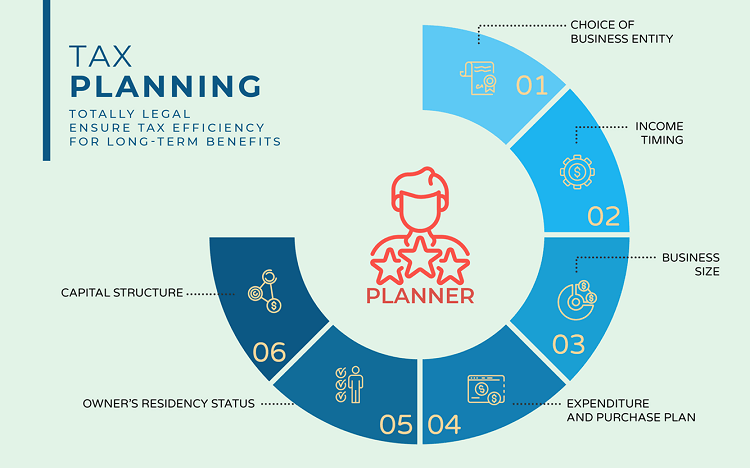

Tax planning refers to the process of organizing your finances in a way that minimizes your tax liability while still achieving your financial goals. With proper tax planning, you can reduce the amount of taxes you pay each year, which means more money saved or invested towards supporting your child’s education.

Here are 15 essential tips for parents of alternative schooling and education:

1. Take advantage of tax deductions for educational expenses

The IRS offers several tax deductions for educational expenses such as tuition fees, books, supplies, and equipment required by the school or program attended by your child. Make sure to keep track of these expenses throughout the year and claim them on your tax return.

2. Consider opening a 529 college savings plan

A 529 plan is an investment account specifically designed to help families save money for college or other qualified higher-education costs. Contributions made to this account grow tax-free over time, and withdrawals used towards qualified educational expenses are also free from federal taxes.

3. Use an Education Savings Account (ESA)

An ESA allows parents to contribute up to $2,000 per year per child towards their educational expenses until they reach age 18. The contributions grow on a tax-deferred basis until withdrawn from the account.

4. Claim credits for dependent care expenses

If you have children under age 13 who attend alternative schooling programs or daycare while both parents work outside their home or are enrolled in school themselves full-time; then it may qualify them for dependent care credit when filing their yearly taxes.

5. Deduct expenses for homeschooling

For parents who have decided to educate their children at home, they may be eligible to deduct some of the expenses incurred. These include costs for books, supplies and materials as well as payments made to tutors or online educational platforms.

6. Consider investing in a Health Savings Account (HSA)

An HSA is an account that you can use to pay for qualified medical expenses tax-free. If you are enrolled in a high-deductible health plan, contributions made towards this account are tax-deductible.

7. Maximize your retirement savings

Contributions made towards your retirement accounts such as 401(k) and IRA grow on a tax-deferred basis until withdrawn during retirement years when taxes are generally lower than during working years.

8. Take advantage of charitable donations

Charitable donations not only help support important causes but also reduce your taxable income by allowing you to claim them as deductions on your tax return.

9. Keep thorough records

Maintaining accurate financial records throughout the year will make it easier when it comes time to file taxes and claim deductions or credits related to alternative schooling and education expenses.

10. File early

Filing early reduces the risk of making mistakes on taxes returns due to rushing through paperwork which could lead to missed opportunities for deductions or credits.

11. Use software programs like TurboTax®or H&R Block®to file online easily & efficiently!

Many software programs exist nowadays that make filing taxes more manageable even without professional assistance; hence there’s no excuse why everyone shouldn’t take advantage of these resources!

12. Stay informed about changes in Tax laws & regulations regarding Education Expenses!

It is essential always stay up-to-date with changing regulations concerning education-related tax benefits because failing do so might lead one into losing out on valuable opportunities available each year based upon current laws/regulations governing such benefits!

13. Seek Professional Assistance where necessary

If getting confused by the complexity of the tax laws or needing additional advice on alternative schooling and education-related tax planning issues, it may be worth seeking professional assistance from a financial planner or tax advisor.

14. Communicate with your child’s school about alternative schooling expenses

Parents who have chosen an alternative schooling approach for their children should communicate with the school or program administrators to ensure that they are aware of any available educational deductions, credits, grants, and scholarships applicable to their students.

15. Stay organized

Keeping all relevant paperwork and receipts in one place will make it easier when filing taxes each year as you’ll have everything you need in hand without having to spend extra time hunting down documentation.

In conclusion, these 15 tips can help make tax planning less daunting for parents of alternative schooling and education while providing them opportunities to save money towards supporting their child’s education goals!

Leave a comment