Financial Planning for Extended Trips or Gap Years

Taking an extended trip, whether it’s a gap year before college or a sabbatical from work, can be a life-changing experience. However, it also requires careful financial planning to ensure that you have enough money to cover your expenses and make the most of your time away. Here are ten tips for financial planning for extended trips.

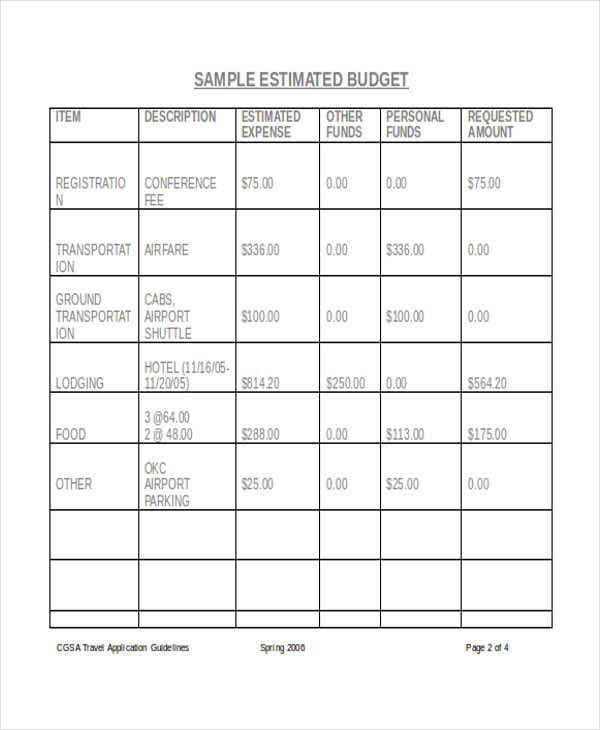

1. Create a budget

The first step in any financial plan is to create a budget. This will help you understand how much money you need to save and how much you can spend while traveling. Start by listing all of your expected expenses, including transportation, lodging, food, entertainment, and travel insurance.

2. Research destinations

Researching destinations can help you estimate costs associated with different locations around the world. You may find that some countries are more expensive than others when it comes to food and lodging costs or that airfare prices vary depending on the season.

3. Set savings goals

Once you’ve created a budget and researched destinations, set savings goals based on your projected expenses for each location on your itinerary.

4. Consider working while traveling

If possible consider working abroad during your trip to earn extra income along the way; this could include teaching English as foreign language (TEFL) opportunities or freelance work online.

5. Use credit cards wisely

Credit cards can be useful tools when traveling but they should not be relied upon entirely as cash advances come with high fees and interest rates added onto purchases made overseas which quickly add up over time.

6. Choose affordable accommodations

Staying in hostels instead of hotels is one way to save money while traveling but there are plenty of other options such as Airbnb rentals or couchsurfing platforms where locals offer free accommodation in exchange for cultural exchange experiences

7. Cook meals at home

Cooking meals at home rather than eating out every meal saves significant amounts over time – especially if shopping at local markets for fresh produce and ingredients.

8. Travel during off-peak season

Traveling during off-peak seasons can save money on airfare, lodging, and activities as prices tend to be lower than peak tourist times.

9. Consider travel insurance

Travel insurance is a must-have for any extended trip because it protects you from unexpected medical expenses or trip cancellations. Shop around for affordable plans that meet your needs.

10. Track expenses

Tracking expenses using apps like Mint or Expensify will help keep tabs on where your money is going and allow you to adjust your budget accordingly if necessary.

In conclusion, extended trips require careful financial planning but can also provide opportunities to learn new skills while experiencing different cultures. By creating a budget, researching destinations, setting savings goals, working while traveling when possible, using credit cards wisely, choosing affordable accommodations such as hostels or Airbnb rentals rather than hotels; cooking meals at home instead of eating out every meal; traveling during off-peak seasons when possible; considering travel insurance before departing abroad; and tracking expenses with an app can all contribute towards making the most of these once-in-a-lifetime experiences without breaking the bank!

Leave a comment